|

RESIDENTIAL STATUS

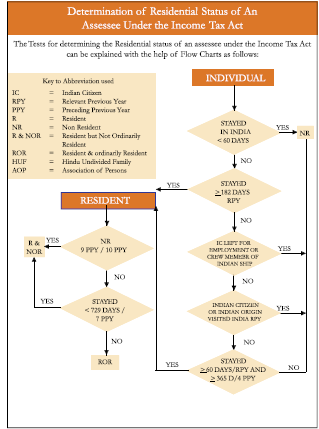

In India, as in many other countries, the charge of income tax and the scope of taxable income varies with the factor of residence. There are two categories of taxable entities viz. (1) residents and (2) non-residents. Residents are further classified

into two sub-categories (i) resident and ordinarily resident and (ii) resident but not ordinarily resident. The law prescribes two alternative technical tests of residence for individual taxpayers. Each of the two tests relate to the physical presence of the taxpayer in India in the course of the “previous year” which would be the twelve months from April 1 to March 31.

A person is said to be “resident” in India in any previous year if he

- is in India in that year for an aggregate

period of 182 days or more; or

- having within the four years preceding

that year been in India for a period of 365 days or more, is in India in that year

for an aggregate period of 60 days or

more.

The above provisions are applicable to all individuals irrespective of their nationality. However, as a special concession for Indian citizens and foreign citizens of Indian origin, the period of 60 days referred to in Clause (b) above, will be extended to 182 days in two cases: (i) where an Indian citizen leaves India in any year for employment outside India; and (ii) where an Indian citizen or a foreign citizen of Indian origin (NRI), who is outside India, comes on a visit to India.

In the above context, an individual visiting India several times during the relevant “previous year” should note that judicial authorities in India have held that both the days of entry and exit are counted while calculating the number of days stay in India, irrespective of however short the time spent in India on those two days may be.

A “non-resident” is merely defined

as a person who is not a “resident” i.e. one who does not satisfy either of the two prescribed tests of residence.

An individual, who is defined

as Resident in a given financial

year is said to be “not ordinarily resident” in any previous year if he has been a non-resident in India 9 out of the 10 preceding previous years or he has during the 7 preceding previous years been in India for a period of, or periods amounting in all to, 729 days or less.

Till 31st March 2003, “not ordinarily resident” was defined

as a person who has not been resident in India in 9 out of 10 preceding previous years or he has not during the 7 preceding previous years been in India for a period of, or periods amounting in all to, 730 days or more.

Section 6 of the Income-tax Act, 1961, prescribes the tests for determining the residential status of a person. Section 6, as amended, reads as follows:

For the purposes of this Act,

(1) An individual is said to be resident in India in any previous year, if he

- is in India in that year for a period

or periods amounting in all to one hundred and eighty-two days or more; or

- [* * *]

- having within the four years

preceding that year been in India

for a period or periods amounting

in all to three hundred and sixty five

days or more, is in India for a period or periods amounting in all to sixty days or more in that year.

Explanation.- In the case of an individual,

(a) being a citizen of India, who leaves

India in any previous year [as a

member of the crew of an Indian

ship as defined

in clause (18) of

section 3 of the Merchant Shipping

Act, 1958 (44 of 1958), or] for the

purpose of employment outside

India, the provisions of sub-clause

(c) shall apply in relation to that

year as if for the words “sixty days”,

occurring therein, the words “one

hundred and eighty-two days” had

been substituted

(b) being a citizen of India, or a person

of Indian origin within the meaning

of Explanation to clause (e) of

section 115C, who, being outside

India, comes on a visit to India in

any previous year, the provisions of

sub-clause (c) shall apply in relation to that year

as if for the words “sixty days”,

occurring therein, the words “one

hundred and eighty-two days” had been substituted.

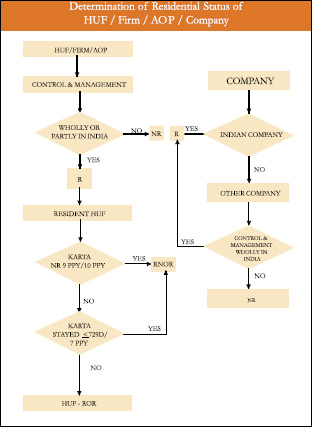

(2) A Hindu undivided family, firm

or other association of persons is said to be resident in India in any previous year in every case except where during that

year the control and management of its affairs is situated wholly outside India.

(3) A company is said to be resident in India

in any previous year, if

(a) it is an Indian company; or

(b) during that year, the control and

management of its affairs is situated wholly in India.

(4) Every other person is said to be resident

in India in any previous year in every

case, except where during that year the

control and management of his affairs

is situated wholly outside India.

(5) If a person is resident in India in a

previous year relevant to an assessment

year in respect of any source of income,

he shall be deemed to be resident in

India in the previous year relevant to the

assessment year in respect of each of

his other sources of income.

(6) A person is said to be “not ordinarily

resident” in India in any previous year if

such person is

(a) an individual who has not been a

non-resident in India in nine out

of the ten previous years preceding

that year, or has not during the

seven previous years preceding that

year been in India for a period of,

or periods amounting in all to, seven

hundred and twenty-nine days or

less; or

(b) a Hindu undivided family whose

manager has not been non-resident in India in nine out of the ten previous years preceding that year, or has not during the seven previous years preceding that year been in India for a period of, or periods amounting in all to, seven hundred and twenty-nine days or less.

An analysis of the above provisions would indicate that

1. To become a non-resident for

income- tax purposes, an Indian citizen

leaving India for the first time to take up employment abroad should be out of

the country latest by 28th September

and should not return to India before

1st April of the next year. However, in

case of a person leaving India for taking

up a business or profession, the criteria

of 60 days will apply, as defined

earlier.

2. An NRI individual, whose total stay

in India in 4 preceding years exceeds

364 days, will not lose his non-resident

status in the following year(s) if his total

stay in India in that year (from April 1 to

March 31) does not exceed-

(a) 181 days, if he is on a “visit” to India; or

(b) 59 days, if he comes to India on “transfer of residence”.

3. An NRI who has returned to India for

settlement, whose total stay in India for

4 preceding years does not exceed 364

days will not lose his non-resident status

in the following year(s) if his total stay

in India in such year(s) (from April 1 to

March 31) does not exceed 181 days.

4. A new-comer to India would be treated

as “not ordinarily resident” for the first

two years of his stay in India or if treated

as Non Resident in the year of arrival

then for the second and third year of his stay in India. An individual (whether Indian or foreign citizen) who has lefit

India and remains non-resident for at least nine years preceding his return to India or whose stay in 7 years preceding the year of return has not exceeded 729 days would, upon his return, be treated as “non-resident” or “not ordinarily resident” depending upon the number of days stay in India in the year of return. The status of “not ordinarily resident” will remain effective for 2 years including or following the year of return as the case may be.

Important Points to be Borne in Mind while Determining the Residential Status of an Individual

- Residential status is always determined

for the Previous Year because the

assessee has to determine the total

income of the Previous Year only. In

other words, as the tax is on the income

of a particular Previous Year, the enquiry

and determination of the residence

qualification

must confine

to the facts

obtaining in that Previous Year.

- If a person is resident in India in a

Previous Year in respect of any source

of income, he shall be deemed to be

resident in India in the Previous Year

relevant to the Assessment Year in

respect of each of his other sources of

Income. [Section 6(5)]

- Relevant Previous Year means, the

Previous Year for which residential

status is to be determined

- It is not necessary that the stay should

be for a continuous period.

- It is not necessary that the stay should

be at one place in India.

- Both the day of entry and the day of

departure should be treated as the day

of stay in India [Petition No.7 of 1995

225 ITR 462 (AAR)]

- Presence in territorial waters in India

would also be regarded as stay in India.

- A person is said to be of Indian Origin if he or either of his parents or any of his grand parents was born in undivided India [Section 115C]

- Offcial tours abroad in connection with employment in India shall not be regarded as employment outside India.

- A person may be resident of more than one country for any Previous Year.

- Citizenship of a country and residential status of that country are two separate concepts. A person may be an Indian national/Citizen but may not be a resident in India and vice versa.

Points to be Considered by NRIs

• Previous Year is period of 12 months

from 1st April to 31st March. Number

of days stay in India is to be counted during this period.

• Both the Day of Arrival into India and

the Day of Departure from India are

counted as the days of stay in India (i.e.

2 days stay in India).

• Dates stamped on Passport are normally

considered as proof of dates of

departure from and arrival in India.

• It is advisable to keep several

photocopies of the relevant passport

pages for present and future use.

• Ensure that date stamped on the

passport is legible.

• Keep track of no. of days in India

from year to year and check the same

before making the next trip to India.

It is advisable to maintain a chart for the number of days stay in the current and in the preceding seven (7) previous years.

• In the 1st year of leaving India for

employment outside India, ensure

that you leave before 29th September. Otherwise total income of the financial

year (including the foreign income) will

be taxable in India if it exceeds the basic

exemption limit.

• During the last year of stay abroad, on

transfer of residence to India, ensure

to come back on or after Feb 1st (or

Feb 2nd in case of a leap year). Since

arrival before this date will result in stay

in India exceeding 59 days. However, a

person whose stay in India in preceding

four (4) previous years does not exceed

365 days, he may return after September

30th of the relevant year without loss of

non-resident status.

Implications of Residential Status for NRIs/PIOs

The complexities of determining the residential status for individual NRI/PIO under various statutes and regulations will be obvious from the provisions outlined above and in this context it would be important to note the following:

- The concepts and rules for determining

the residential status income-tax laws

and FEMA are quite different and it

would be possible to be a resident under one law and non-resident under the other.

- For exemption of income tax in respect of NRE and FCNR deposits investor should be non-resident under FEMA.

- The special tax rate concessions on income and long-term capital gains on specified

assets, purchased in convertible foreign exchange are available to nonresidents under the Income-tax Act.

CHARGEABLE INCOME

Section 5 of the Income-tax Act lays down the scope of total income of any previous year of any person. The section reads as follows:

(1) Subject to the provisions of this Act,

the total income of any previous year of

a person who is a resident includes all

income from whatever source derived

which-

(a) is received or is deemed to be received in India in such year by or on behalf of such person ;or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year; or

(c) accrues or arises to him outside India during such year:

Provided that, in the case of a person not ordinarily resident in India within the meaning of sub-section (6) of Section 6, the income which accrues or arises to him outside India shall not be so included unless it is derived from a business controlled in or a profession set up in India.

(2) Subject to the provisions of this Act,

the total income of any previous year of

a person who is a non resident includes

all income from whatever source derived

which

(a) is received or is deemed to be received in India in such year by or on behalf of such person; or

(b) accrues or arises or is deemed to accrue or arise to him in India during such year.

Explanation I.-Income accruing or arising outside India shall not be deemed to be received in India within the meaning of this section by reason only of the fact that it is taken into account in a balance sheet prepared in India.

Explanation 2.-For the removal of doubts, it is hereby declared that income which has been included in the total income of a person on the basis that it has accrued or arisen or is deemed to have accrued or arisen to him shall not again be so included on the basis that it is received or deemed to be received by him in India.”

Thus, it is clear from the above that the incidence of tax depends upon a person’s Residential Status and also upon the place and time of accrual and receipt of income.

As stated earlier, the charge of income tax varies with the factor of residence in the previous year and the general position with regard to the three categories of taxpayers can be summarised as follows:

1. Taxpayers in all categories are chargeable on income, from whatever source derived, which is received or is deemed to be received in India by or on behalf of them or which accrues or arises or is deemed to accrue or arise to them in India other than income specified

as exempt income.

In tabular form, the above may be stated as under

Sources of Income |

R & OR |

R & NOR |

NR |

Indian Income

Income received or deemed to be received in India during the current financial

year. |

Taxable in India |

Taxable in India |

Taxable in India |

Income accruing or arising or deemed to accrue or arise in India during the current financial

year. |

Taxable in India |

Taxable in India |

Taxable in India |

Income accruing or arising or deemed to accrue or arise out side India, but first receipt is in India during the current financial

year |

Taxable in India |

Taxable in India |

Taxable in India |

Foreign Income

Income accruing or arising or deemed to accrue or arise outside India and recieved outside India, during the current financial

year. |

Taxable in India |

Taxable in India |

Not Taxable in India |

Income accruing or arising or outside India from a Business/ profession controlled in/from India during the current financial

year. |

Taxable in India |

Taxable in India |

Not Taxable in India |

Income accruing or arising out side India from any source other than Business Profession controlled from India |

Taxable in India |

Taxable in India |

Not Taxable in India. |

In the above context, it may be noted that the ‘receipt’ of income refers to the first occasion when the recipient gets the money under his own control and it is the first receipt that determines the year and place of receipt for the purposes of taxation. If the income is already received outside India, no tax liability will arise when the whole or any part of such income is remitted to India.

2. A “resident and ordinarily resident” pays

tax in India on his entire world income,

wherever accrued or received.

3. A “non-resident” pays tax only on his

taxable Indian income and his foreign

income (earned and received outside

India) is totally exempt from Indian

taxes.

4. A “not ordinarily resident” pays tax

on taxable Indian income and on

foreign income derived from a business controlled in or a profession set up in India

5. An individual upon acquiring the status of “not ordinarily resident” would not pay tax, for a period of two years, on the interest on :

a) the continued Foreign Currency Non-Resident (FCNR) account;

(b) the Resident Foreign Currency (RFC) account; and

(c) on income earned from foreign

sources unless such income is directly received in India or is earned

from a business controlled in or a profession set up in India.

|